[ad_1]

Robinhood’s long-awaited international expansion is at full throttle. The consumer trading and investment app tailored to the younger generations is launching its crypto app to all eligible users in the European Union, the company said Thursday.

The announcement comes on the heels of its foray into the U.K. just a week ago. While it’s taking crypto trading to EU customers, it’s only making its brokerage service available in the U.K. for now.

The EU has been at the forefront of formulating regulations to enforce the traceability of crypto for anti-money laundering and protecting retailers from market volatility. Among the most important frameworks is the Markets in Crypto-Assets (MiCA) rule, which focuses on stablecoin regulation and is seen as one of the world’s most comprehensive regimes for crypto assets.

“The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans,” Johann Kerbrat, general manager of Robinhood Crypto, said in a statement.

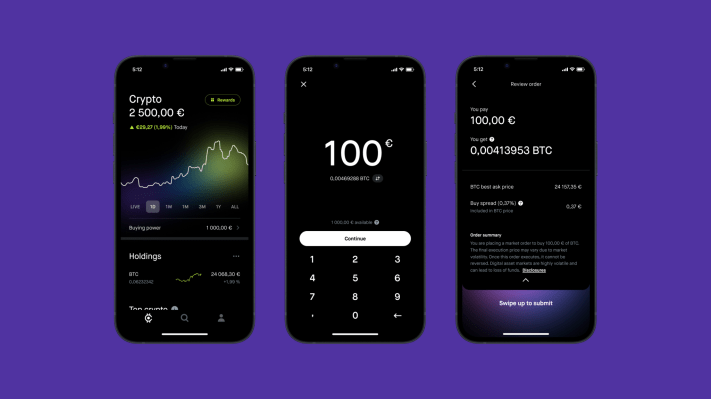

Aside from boasting low fees, Robinhood claims it’s the only custodial crypto platform — where customer funds lie in the custody of the exchange rather than their self-hosted wallets — will get a percentage of their trading volume back every month, paid in Bitcoin. Users in the EU can buy and sell some 25 cryptocurrencies, including major ones like Bitcoin and Ethereum.

Robinhood is taking other measures to assure European users that they are getting their money’s worth, given its past business practices have been less than ideal. In the U.S., the Securities and Exchange Commission has criticized the stock trading app for misleading users about how it makes money and failing to deliver its promise of the best execution of trades. It ended up paying $65 million to settle these SEC charges.

In its crypto endeavor in the EU, Robinhood promises transparency by displaying the trading spread, which includes the rebate it receives from sell and trade orders in the app.

It also guarantees it will never commingle customer coins with business funds other than for operating purposes, such as payment of network fees. In the aftermath of FTX’s collapse, users are increasingly wary of centralized, custodial crypto platforms and switching to decentralized alternatives.

Robinhood itself has been skittish about its crypto operations. In June, it voluntarily moved to limit the trading and holding of certain tokens for its U.S. customers, at a time when the government was taking a firmer stance against trading giants like Binance and Coinbase.

The Robinhood Crypto app, available on iOS and Android starting today, is restricted to European citizens who are over 18 years old. The platform has plans to include more tokens and add new features like crypto transfers, staking and learning rewards in 2024.

[ad_2]

Source link