[ad_1]

Cloud detection and response company Gem Security today announced that it has raised a $23 million Series A round led by GGV Capital, with participation from IBM Ventures and Silicon Valley CISO Investments. It was only in February that Gem announced its $11 million seed round led by Team8, which also participated in this new round.

A few years ago, we saw a number of companies that quickly raised seed, Series A and — sometimes — Series B rounds within months of each other. In today’s market, that’s become quite unusual. For the right company with the right fundamentals, it’s still possible to raise multiple rounds within a year, though, even as investors have become more cautious. Cloud security is one of those markets, with enterprises quickly adopting cloud-native technologies and moving much of their infrastructure into the cloud — and often using multiple clouds, which only complicates how they think about their security posture.

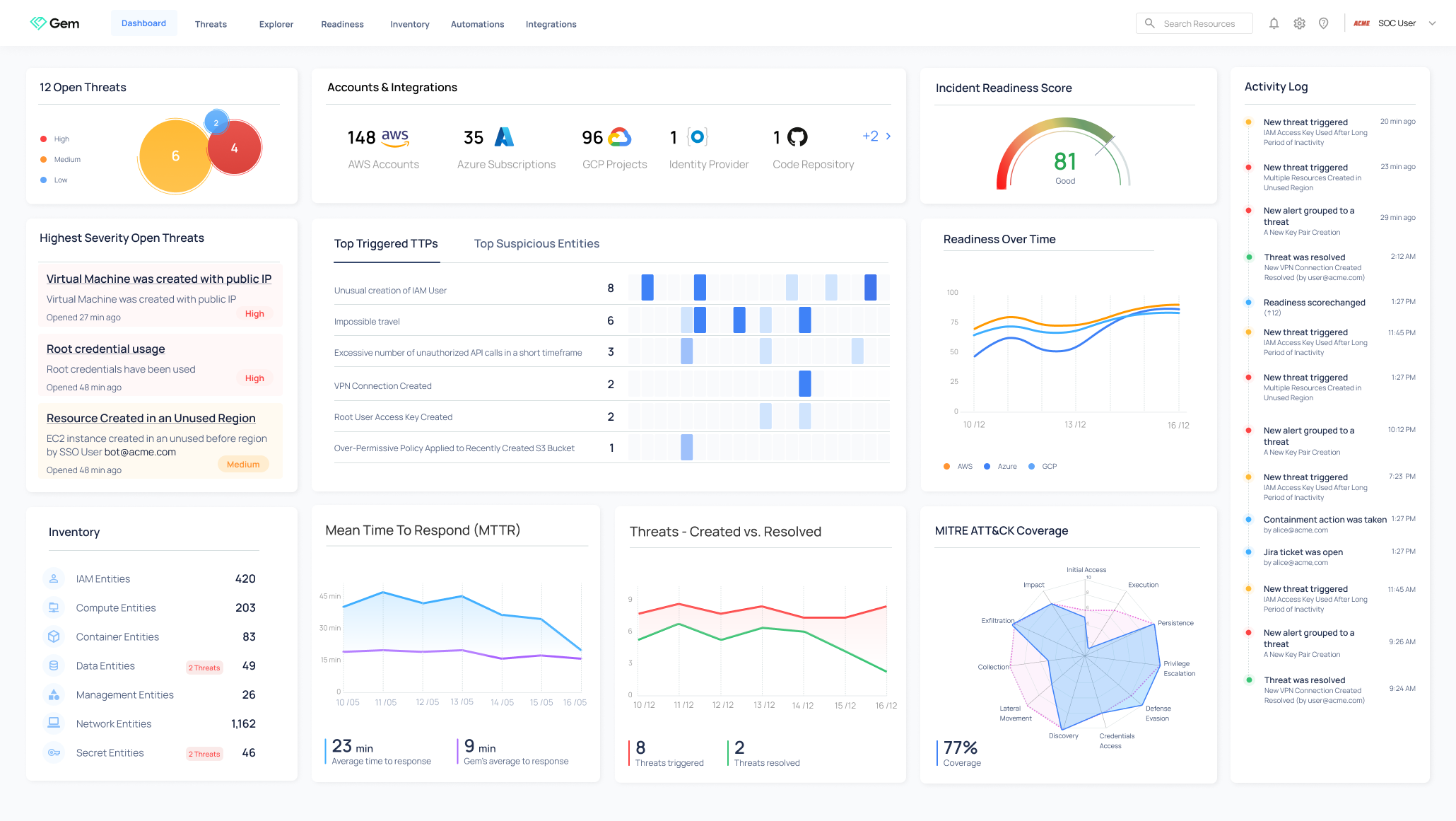

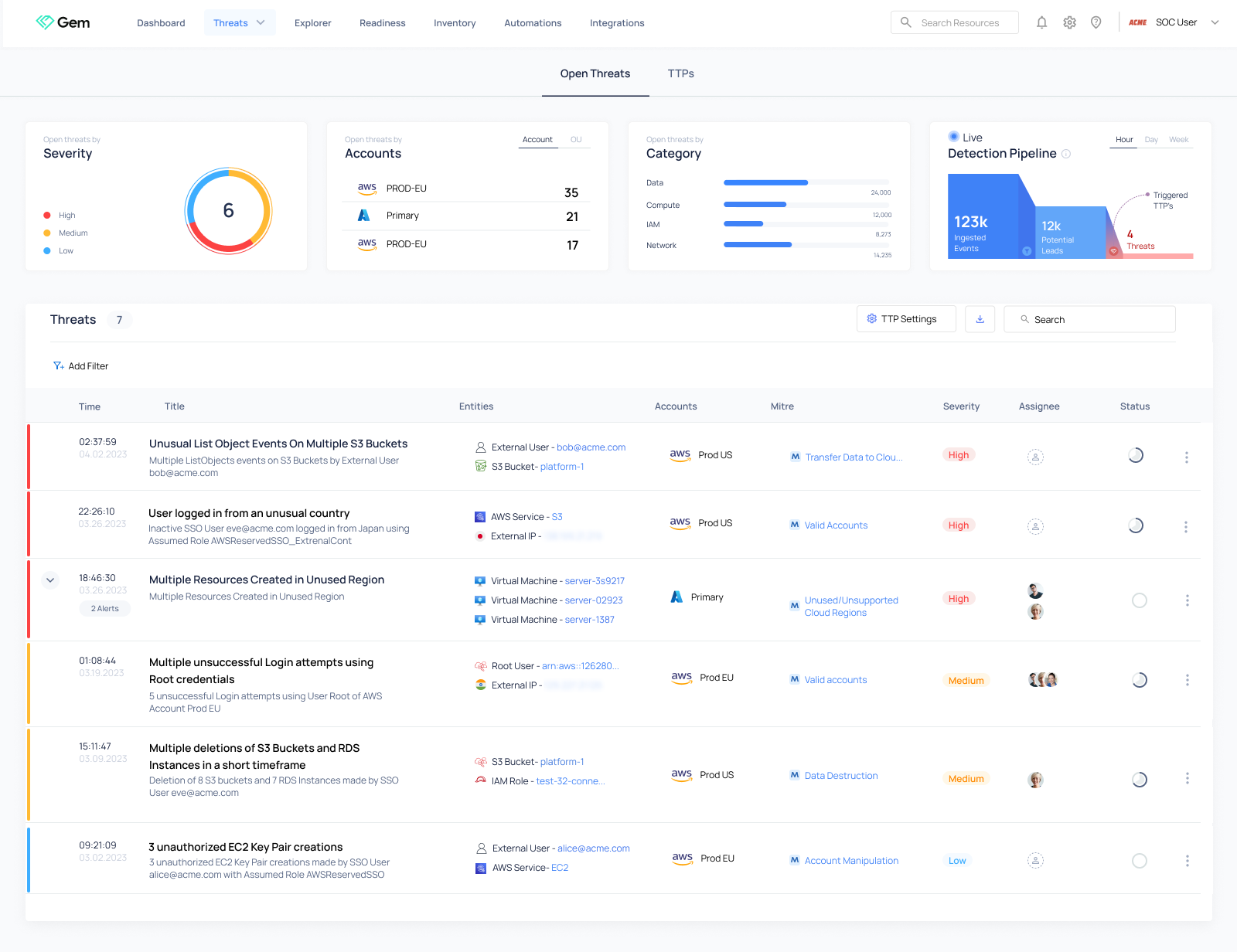

“With the shift to the cloud, the security operations model needs to evolve,” said Oren Yunger, partner at GGV Capital. “Security teams don’t reliably know when they are being attacked, let alone why or how those attacks are occurring. Gem has built a unique platform that allows CISOs and their teams to prepare, detect, respond and remediate cloud security attacks — with context and fast.”

Founded in 2022, the company only launched its service earlier this year, but it has already signed up dozens of enterprises, including the likes of energy giant Repsol, social engagement platform OpenWeb, healthcare company Thirty Madison, cloud video platform Kaltura and the investment company Allan Gray.

“I usually say that the right time to raise money is either when you have the opportunity or when you feel that if you don’t raise this money, you won’t be able to grow as fast as you want,” Gem co-founder and CEO Arie Zilberstein told me when I asked him about raising two rounds so shortly after each other. “The combination of these two reasons allowed us and motivated us to raise in this time. I am aware that the markets are the same as in 2021. However, I do sense that for companies that show traction and that there’s a market need — actual evidence of problems that are being solved — then the situation is easier. Not easy, because it’s not, but easier.”

He noted that investors aren’t just looking for the number of numbers but also about what the customers are saying about a company.

“There’s a huge technology transformation that is happening,” Zilberstein said. “There are many cloud security companies that already exist, but what we do at Gem is tackling the next phase of that cloud security transformation, which is not only about how to build environments in a secure way, which is the foundation — and there are many companies that are doing that. But it’s actually the next phase that is dealing with what is happening right now. It’s not only protecting the perimeter and hoping for the best, which is a good start, it’s also acknowledging that something will inevitably happen and you need to make sure that you have the right sensors and the means to respond when it happens — and to respond in a timely manner for the impact to not ever happen.”

Like so many other companies, Gem is now also looking at how it can use generative AI to improve its products. Zilberstein noted that the company’s focus here is on helping security analysts be more efficient and maybe automate some of their work — though always with a human in the loop.

The company is also looking at enhancing its forensics capabilities and expanding from protecting infrastructure services to also covering other platforms and SaaS integrations while remaining true to its focus on detection and response.

[ad_2]

Source link